November is a crucial month for global retail, as it marks the start of the holiday shopping season and features the world’s two biggest shopping events: China’s Double 11 and the US’s Black Friday-Cyber Monday.

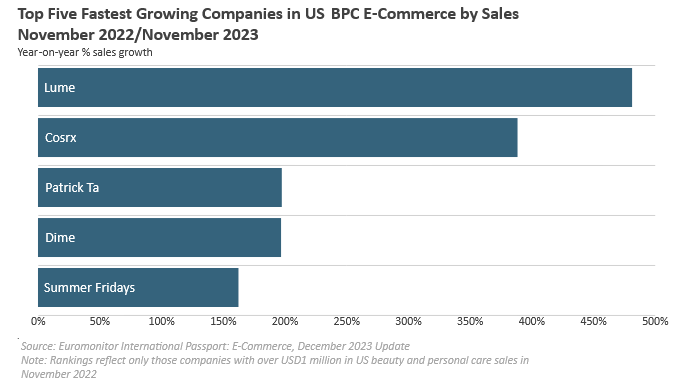

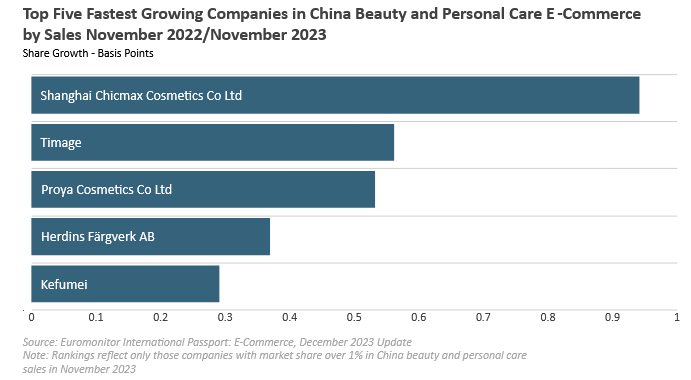

With Euromonitor International’s new Passport: E-Commerce system, we can now analyze the online sales of over 500 FMCG categories in this key period. In this article, we examine how beauty and personal care (BPC) products performed online in China and the US in November 2023.

The online sales performance of color cosmetics diverges in China and the US

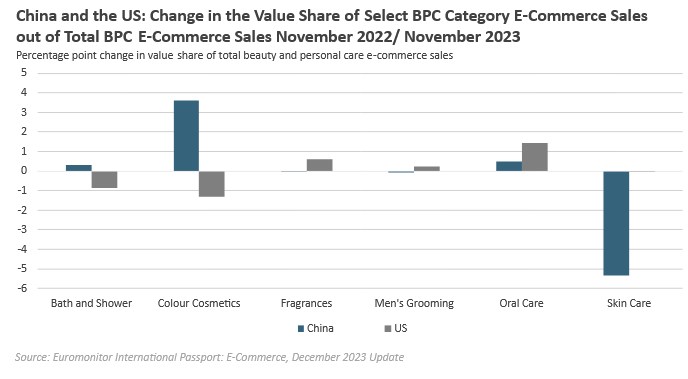

In 2023, the US economy worries consumers, as inflation is still high and spending is low. This affects the holiday shopping season. Some BPC categories in the US do better than others online. Oral care gains 1.5% share, while color cosmetics lose the same. In China, Double 11 is a huge shopping festival that reflects the consumer economy. In 2022, November sales were more than 16% of the annual sales of 12 FMCG industries online.

The BPC market in China is constantly changing, and two important trends stood out in November 2023. First, skin care products lost a lot of value share in the BPC e-commerce sales, falling by 5.3 percentage points from the previous year. On the other hand, color cosmetics gained a lot of value share, increasing by almost 3.6 percentage points. This shows that more people are interested in and buying color cosmetics, indicating a possible rise in the demand for make-up products.

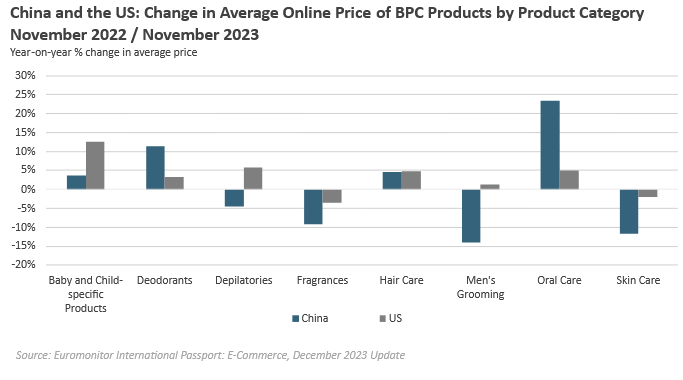

However, it is clear that, in some other categories, brands and retailers are engaging in heavy discounting in a bid to lure shoppers. For example, the average prices of fragrance products purchased online in November decreased by 4% compared to the year before.

Leave a Reply