According to AppsFlyer’s Black Friday data, e-commerce apps overcame the challenges of a new privacy environment and wary shoppers and achieved better results than in 2022.

Mobile spending surpassed desktop spending, deals became more attractive, and consumers took advantage of ‘pay later’ options to stretch their budgets. This coincided with a surge in app downloads and effective user acquisition campaigns on iOS.

Table of Contents

ToggleSurge in e-commerce and mobile-driven sales

The digital economy has seen mobile as a major source of growth, as many shoppers prefer the convenience of using their smartphones. In the US, online sales from smartphones accounted for 51.8% (up from 49.9% in 2022) of the total, while in the UK, mobile spending also surpassed desktop spending, making up more than half (£6.5bn out of £12bn) of the online spending from November 1st to 27th.

According to AppsFlyer’s data, the app-centric strategy of UK retailers led to a 22% increase in eCommerce app spending on Black Friday 2023 compared to Black Friday 2022, and the US followed suit with a 13% rise.

Strategic marketing on iOS is reaping rewards

Apple’s stricter privacy policies under ATT have made mobile advertising more challenging, but marketers’ smart tactics in iOS have paid off. In the UK, Android installs increased by 40% and iOS installs by 99% in November, compared to November 2022.

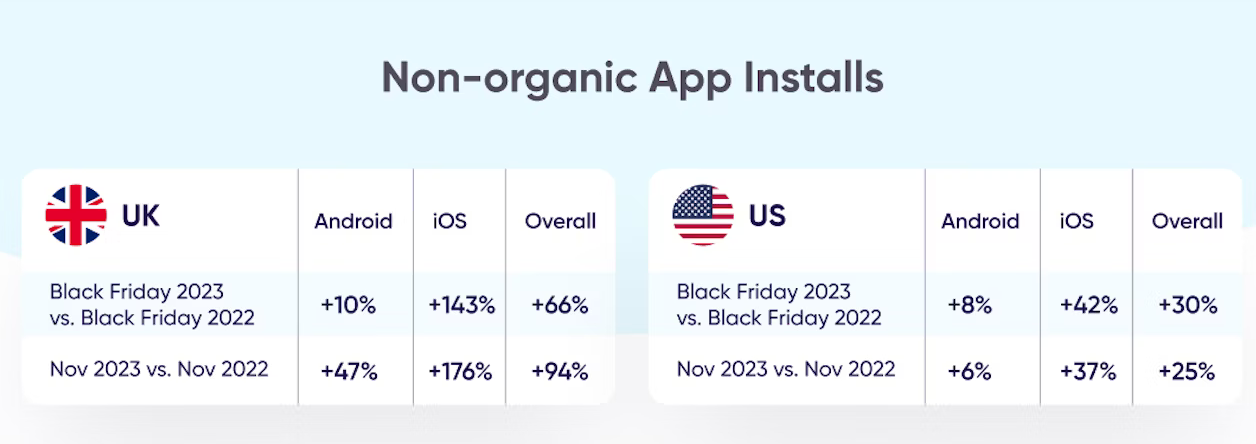

Non-organic installs, however, showed a contrast between iOS and Android. In the UK, iOS non-organic installs for November soared by 176% from November 2022, while Android lagged at 47%. In the US, iOS non-organic installs grew by 37% for November 2023 versus November 2022, but Android barely improved, rising only 6% in the same timeframe.

UK brands and consumers widened their installation and shopping windows

According to AppsFlyer’s data, Black Friday is no longer a one-day shopping frenzy. Shoppers began to download their apps earlier in November and maintained a high pace until the end of the month, extending the shopping season, or at least the intention to spend, throughout the whole month.

In recent years, Black Friday has grown from a single-day event to a month-long affair, with brands eager to widen the opportunity to spend. The prolonged period of high installs may have been influenced by creative retailers such as Puma Group, H&M, and Gymshark, who adopted an app-focused loyalty-based strategy, offering app-only Black Friday deals with discounts to attract new app users and reward existing ones.

Creative retailers who started or prolonged their sales also had the advantage of capturing Black Friday shoppers a week before most UK workers got paid. For instance, skincare brand, The Ordinary, gave 23% off on purchases throughout November in a campaign that invited consumers to shop at their own pace.

US shoppers had the highest installs on Black Friday itself when they rose by 49% in the two weeks leading up to Black Friday and were less inclined to start downloading earlier in the month.

Heavier discounts and BNPL swung price-conscious consumers

Compared to 2022, US discounts increased across most categories tracked, with computers at 24% (versus 20%), TVs at 19% (versus 17%), and clothing at 23% (versus 18%). In the UK, average online prices dropped by 12 percent compared to pre-holiday season levels.

In the US, Cyber Monday online spending reached $940 million with Buy Now, Pay Later (BNPL), rising by an astonishing 42.5% YoY as consumers looked for more adaptable payment options. UK shoppers spent £101m with BNPL on Black Friday, making up 9.7% of the total online spending for the day, and showing a 3.4% increase from Black Friday 2022.

Marketers’ efforts paid off

Marketing teams have adjusted well to the new privacy environment, acknowledging the importance of iOS, and exploiting this platform by investing resources, achieving remarkable returns. In 2024, marketers will have to keep enhancing customer engagement, fine-tuning their post-Black Friday activity and along with it, user loyalty, to enjoy the benefits into 2024 and beyond.

Leave a Reply